[lead bloggers: Hilary Wilson, Anthony Ramos, and Benjamin Rubin]

In his first lecture in the series, “Anti-Capitalist Thought and Action,” David Harvey created a foundation for understanding the problems of capitalism today, by thinking through Karl Marx’s Capital. Rather than an ideological commitment to (capital M) Marxism, Harvey is motivated to return to a Marxist conceptualization of political economy out of a concern for capitalism’s inherent tendency toward compound growth, and the social and ecological catastrophe it has created. We have lived through a crisis of capitalism that was resolved through debt financing; and are currently in a phase of ever-increasing debt to finance the required growth. Why debt? Money is the only form of capital––unlike productive capacity and commodities––that can increase without a physical limit, and so for the past ten years, money-creation has been turned to in order to pump up economies that can not grow fast enough by other means.

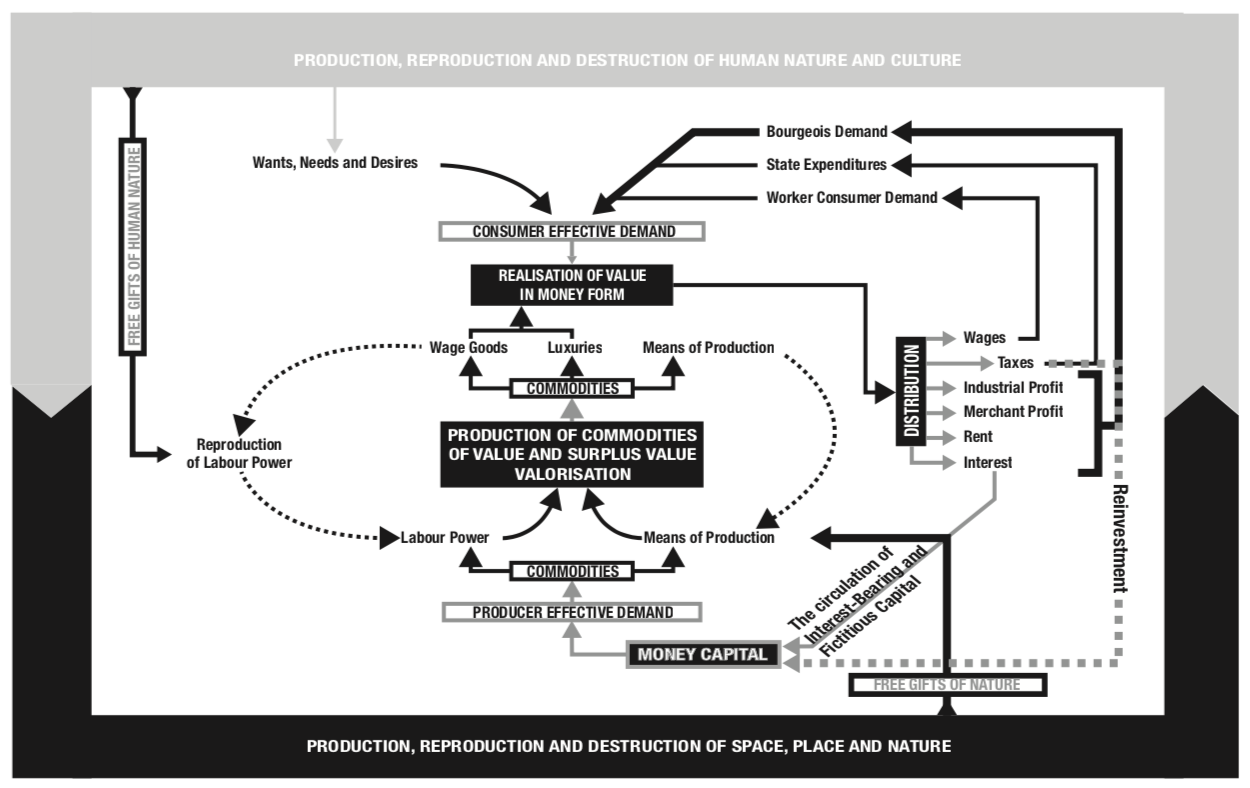

Harvey introduces this lecture series by turning the basic diagram of capital accumulation, M-C-M’, into an expanding cycle or spiral. The diagram has many complexities, but the central point is that capital moves between three distinct phases: 1) Valorization of capital through the production of commodities, 2) Circulation of capital in which it is realized as value, and 3) the Distribution of capital, in which the value in money form is divided between different groups according to different levels of social power. Each of these corresponds to a single volume of Marx’s opus, Das Kapital, and entails particular sets of social relations that operate according to particular logics. While each phase is related to the others, these relationships are not deterministic. Further, because each volume explores only one of these phases, it analyses that phase as if the other two were unproblematic, assuming away the contradictions arising from other the phases. The remainder of this post will give an overview of each phase in capital circulation which was covered in Harvey’s lecture.

Valorization:

Volume I of Capital focuses on the phase of valorization or production. The principal goal in the valorization process is the production of relative surplus value, which can be understood as the equivalent of money capital plus surplus value extracted from labor power. In order for capitalist production to function, there must be an adequate money system and commodity market in place or it must be created. Money capital is used to purchase two kinds of commodities: labor power and the means of production (e.g. physical capital in the form of machinery), while what Marx called “free gifts of nature” (including human nature), are appropriated as the raw materials for the production process. Like subsequent volumes of Capital, Volume I operates under certain assumptions in order to illustrate the particular rules governing the valorization process. Namely, landlords, merchant capitalists, and bankers – all of whom figure prominently in the distribution phase – are largely absent from Volume I. Further, it assumes there are no barriers to the realization of value, which becomes an important point of contradiction in Volume 2. As such, the primary contradiction animating capitalist relations as they relate to valorization is that between labor and capital, with capital incentivized to drive down wages in order to extract as much surplus value as possible, resulting in the increasing immiseration of the working class. Capitalists also undercut labor power through the creation and maintenance of an industrial reserve army of unemployed and alienated workers, as well as through technological change.

Realization:

In Volume 2 of Capital, Marx turns from production to the circulation of capital. Assuming perfect stability in the other forms (stable production––meaning no technological change, and perfect distribution) allows him to engage in the conditions of realization of capital; i.e. the moment when the value that the capitalist assumes and hopes is embodied in commodity C becomes real money as it is sold in the market for M’.

A key contradiction in this process is that different forms of capital circulate at different speeds: capital-as-infrastructure is built with different lifespans, capital-as-production-technology becomes obsolete and replaced at different rates, and so on. This creates a problem of coordinating different time scales which requires some mechanism of deferring the realization of value into the future, or accessing the money form of capital now, based on assumptions of future realization of locked capital: in a word, credit. Conflicts in the speed of circulation are resolved through financial means. Capital stock is valued at a discount rate, money capital is priced via the interest rate, fixed commodities like homes become streams of payment stretched out over years; all showing how credit relations allow the alignment of different temporalities. However, there is no way to hedge against value loss without facilitating speculation- the system of value can not work without fictitious value.

Distribution:

David Harvey described how Karl Marx understood the Distribution of Value in the Form of Money as not a passive stage in the process of Capital but rather a dynamic and active stage. From Harvey’s diagram of this moment of Capitalization, we can visualize the relationship between various participants in the total process of Capital and how surplus-value and Value (or total value) fold back into the larger process. Particularly evident at this moment is not simply the competing interests among the various factions nor the differences between the forms of value, but rather the contradictions (and unity) between, say, the State’s interest in drawing revenues from wages and the power relations driving down wages in field of production.

While reading through Harvey’s recent book, “Madness of Economic Reason,” I made note of how he described another area of the ‘contradictory unity’ of the field of distribution with the fields of realization and valorization:

‘While a lot of wealth is extracted by capital from realisation, even more is sucked out from distribution. The most blatant form of redistribution has to highlight the declining share of labour in the national product in much of the world and the failure of labour in recent times in particular to receive any benefits from rising productivity… The shift from productive to unproductive labour accompanied by excessive bureaucratisation within both the state and corporations has not helped.” (200).

The solution to this contradiction, as we have witnessed in various historical moments since the 1970s, has been financial “innovations” that continue to make new fictitious forms of value — think quantitative easing and the dark CDO markets — and neoliberal economic policies and political pacts. Less talked about, during our first lecture, were the political mechanisms put into place to secure the collection of debts from those who have been enticed or coerced into taking on loans that “innovative” financial mechanisms are backing. This is particularly noticeable for me, especially as I think through Harvey’s assertion that Marx did not consider the working-class to have a say in the field of distribution. Social movements, including Occupy and recently in Michigan, Wisconsin, Puerto Rico, and Venezuela — as well as progressive/reactionary politics like the Bernie campaign and Brexit — have foregrounded fiscal policy and economic inequality in political action.

Discussion Questions

1. As a phase of capital, production is already a terrain of a particular struggle, the struggle between laborers and capitalists. What are the forms of struggle inherent to the other two phases of capital, realization and distribution? How can conflicts over distribution and realization be made part of a class struggle, or an anti-capitalist struggle?

2. Marx described capitalism’s dependence on “free gifts of nature”. Many scholars have pointed to the similarities between the need for cheap nature, and the need for cheap labor. These are not merely analogous. Historically, a key way that labor has been devalued has been by ideological claims about human nature: that native people are closer to a dangerous nature, and thus less civilized; that women are closer to a nurturing nature, and thus naturally suited to domestic care work. How are these ideologies of nature and human nature reflected in Harvey’s expanding spiral of capital?

3. In his talk, Harvey demonstrated that crises often result from contradictions among the various phases in capital circulation, for example, from the inability to realize surplus value because of insufficient demand. At the same time, Harvey emphasized the necessity for anti-capitalist movements to understand that there are different rules governing different games, engendering different social relations at each phase in capital circulation. But I wonder how a focus on the differences between moments or phases in the capitalist economy helps us formulate a strategy for confronting / resolving crises arising from contradictions among these phases. Put another way, while the relations between workers and capitalists is certainly distinct from that between renters and landlords, or creditors and debtors, it seems that what social movements have been less successful at doing is understanding these relations collectively, as interrelated parts of a totality which calls for an expansive, “cross-phase” approach.

4. Strategy: contradictions inherent within phases of capital, vs between the conflicting demands between the different phases of capital.

For Harvey, many of the contradictions of capitalism can be understood as contradictions between the dictates of capital in its different phases. For example, as valorization of capital takes place through the production process, surplus value is extracted from labor; and thus a pressure exists to lower the costs of labor as much as possible. However, the circulation of capital relies on consumer demand, and thus lower wages––while beneficial for the valorization of the capital invested in the production process––become a problem for realizing that value in the market.