[Lead Bloggers: Kathryn, Luca, and Patrick]

This week, David Harvey discussed and elaborated on Marx’s analysis of the role of finance and interest-bearing capital in the broader capitalist mode of production.

The topic had been curiously undertheorized in the Marxist, heterodox, and even mainstream economic literature through most of the 20th century. This absence is particularly odd, given the fundamental centrality of financial instruments to infrastructure construction, long-distance trade, and urbanization.

And yet as debt has increased massively relative to GDP, across the OECD and most recently in China’s consumer-debt-and-concrete urbanization boom, such issues have spurred more attention and analysis. Across the OECD, consumer debt and sovereign/public debt have ballooned to fill the consumption gap created by stagnant real wages and eviscerated corporate taxation since the early 1970s. In the wake of the extend-and-pretend pseudo-resolution of the 2008 financial crisis, the role of finance in capitalist production, circulation, and distribution has become impossible to ignore.

Classical economists often alternated between seeing financial activity as purely epiphenomenal to productive activity, or as parasitic and prone to destabilizing rounds of speculation. Mainstream modern economics, however, has often treated finance as having a neutral effect on the economy, merely facilitating exchange and having little effect on production—an attitude embodied in the fact that most governments did not include financial activities or profits in their GDP calculations until the 1970s. Since then, there have been both glib celebrations and strident critics of the growth of finance, either as one of the “most productive” sectors in the world (according to Lloyd Blankfein), or as an increasing rentier drain on productive investment and a dangerous, casino-style speculation introducing systemic risk that threatens the very “real economy” it supposedly facilitates (see Mazzucato 2018).

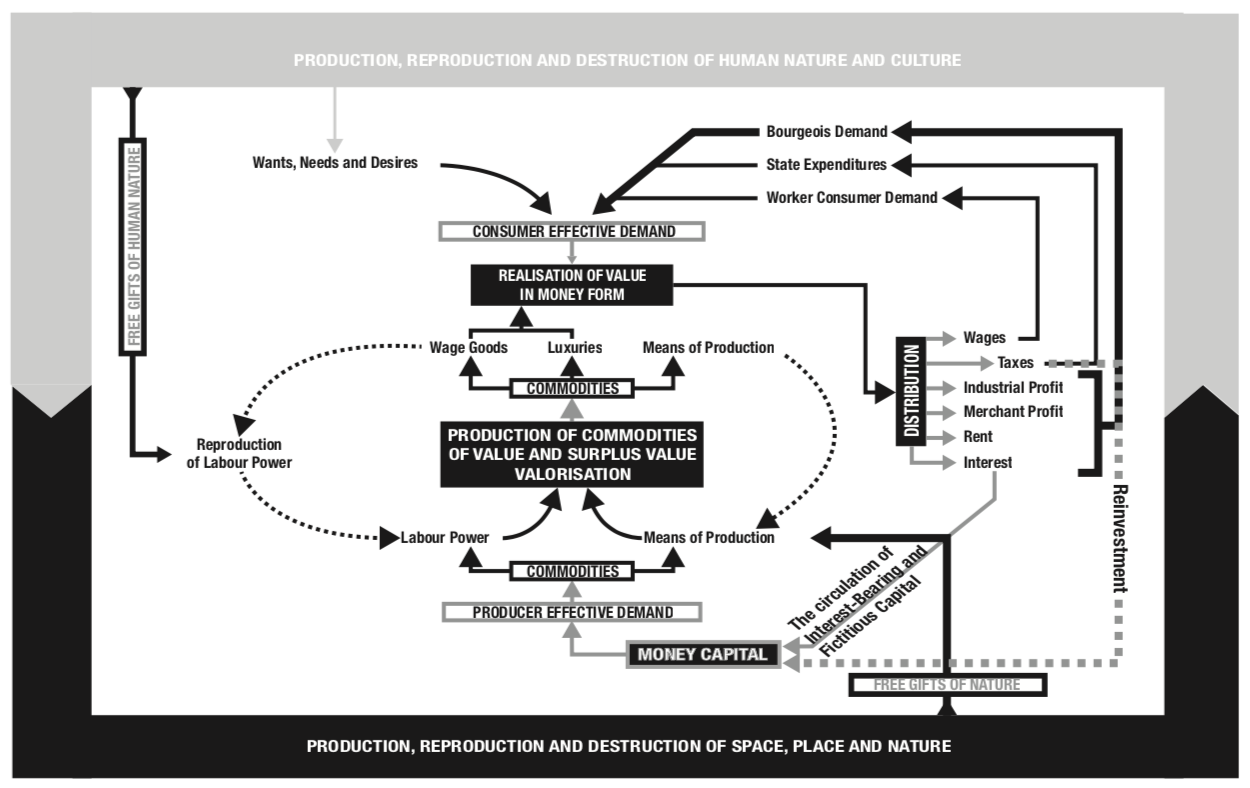

Harvey’s primary argument, first laid out at length in 1982’s Limits to Capital, is that finance actually performs necessary functions in smoothing out interruptions in capital circulation, closing gaps in turnover time between industries, and acting as a central nervous system for capital as a whole, ensuring that capital can move more nimbly and quickly where the market feels it’s most needed—i.e. toward the highest profit rate on offer. By unlocking capital trapped in productive or commodity form, and tapping its expected future cash value, finance speeds up turnover of the total capital in society and thus intensifies the aggregate production of surplus value.

Just like merchants and landlords—not to mention states—money lenders existed before capitalism but are tolerated by the productive capitalist class given the specific functional roles they can perform to secure the conditions for expanded capital accumulation. These actors receive a portion of the surplus value produced in production in return for speeding up capital turnover (so industrialists don’t have to wait to find an individual buyer for every product produced before starting another round of production) or by allocating individual plots of land towards their “highest and best use” for capital (by squeezing inefficient producers off the land and redistributing it to more efficient producers whose activities meet the desires of the market).

Finance makes hoards productive, by ensuring that production can begin before a hoard is amassed (as in an industrial loan), that savings can be unlocked from their waiting place (as with interest-bearing savings accounts), that a house or car can be bought long before a worker has saved up the sticker price (realizing the commodity capital more quickly), or that liability for the inevitable risks of long-distance trade or long-turnover projects can be pooled (as with insurance). Finance keeps capital on the move through the circuit by preemptively releasing it from discrepancies in timing—at least until the loan is due.

Financiers receive their share of surplus value in the form of interest, a kind of “price” paid for the time-limited use (i.e. rental) of money. Harvey argues that such functions (again, as with the state provision of infrastructure, courts, and regulation) are not strictly speaking productive of value, just as Marx argues in Volume I of Capital that a machine cannot itself produce value: such investments rather create the facilitating conditions through which workers can produce surplus value at relatively higher rates of productivity.

The problem for capital as a whole, Harvey argues, is that all of these facilitative powers are inextricable from the same qualities that give them their inherent tendency toward speculative mania and crisis. Without allowing people to own forms of property that allow them to gamble on expected returns and thus “mortgage and foreclose upon the future,” the ability to bridge these gaps will grind to a halt, and capital will have to take much more winding and slow paths through its ever-expanding circuit.

Further, as is clear from the 2008 financial crisis, such functions may pose a whole host of larger problems for a broader economy. The increasing importance of financial activity for productive corporations like General Motors, who finance purchases of their own cars is one example, possibly diverting investment from the “real” economy into such rentier operations. Further, the use of debt as a political tool has as become especially clear: indebted workers may particularly fear to strike and miss payments, unscrupulous lenders may accumulate devalued assets through foreclosure, and states are disciplined toward particular courses of policy action (as with IMF-led structural adjustment programs or the anti-Keynesian architecture of the European Central Bank). Meanwhile, many financial institutions can lend profligately despite significant moral hazard, assured that any risk they take big enough as to be systemic will be covered by a public bailout, nationalizing private losses as public debt.

These developments raise significant questions for anticapitalist strategy, regarding the nature of this mushrooming of financial assets and the balance of class forces given assetization.

Discussion Questions

1. Have increased returns on finance drained investment away from job-creating activity in the “real” productive economy, thus contributing to unemployment and a weak bargaining position for workers? What kind of empirical evidence would we need to determine whether capitalism has been fundamentally transformed by the growth of finance, perhaps shifting the balance of power within capitalist society away from industrial capital and toward financiers? What are the strategic risks of overstating the shift from surplus value production via labor exploitation to “value-grabbing” through debt, rents, and asset seizures? What are the risks of ignoring such transformations if they are happening?

2. The 2009 decision under President Obama to bail out the banks rather than mortgage-holding homeowners stirred considerable debate over alternative ways out of the crisis. Would a more social-democratic or anti-neoliberal government have been able to move toward the democratization of finance and ownership within capitalism from that moment, or would they still be disciplined by international currency markets and “investor confidence”? What kinds of “people’s structural adjustments” are possible through the electoral route, and what are the dangers of such language being co-opted by those who seek to create a simple truce between capital and labor and have abandoned the end goal of a truly democratic control of the economy? In what sense are such interventions anticapitalist? Could any kinds of finance reforms constitute partial, “non-reformist reforms” toward socialism?

3. One of the most pernicious historical forms of right-wing criticism of capitalism has taken the form of attacks limited to the parasitic, amorphous, and world-controlling power of “banksters”—as though capitalism would be moral, stable, and bountiful for all if it weren’t for Goldman Sachs charging high rates of interest. These anticapitalist analyses, which run back at least to Martin Luther, often let industrial capitalists or “small businesses” off the hook, and see shadowy “foreign” financiers (the “globalists”) as the primary source of economic instability, nation-undermining political interference, and working-class suffering. They have most famously (but not only) taken the form of antisemitic conspiracy theories, as when the Nazis taught children that the horrors of British imperialism were the result of Jewish control of the British state. This web of spooky stories, like 9/11 conspiracy theories and the alt-libertarian “Zeitgeist” movement had a certain currency among some people coming to consciousness during the Occupy Wall Street movement, and are a lot easier to get across to most people, graduate students included, than all three volumes of Capital. How does an anticapitalist movement realistically assess the power of finance capital, resist the draw in our own analysis of fairy tales that make up the “socialism of fools” (as August Bebel defined antisemitism), and—most importantly—ensure that a more structural and less demonological analysis of capitalism can empower capitalism’s victims to understand, organize, and change their situation?

=============================================

Harvey, David. 1982. The Limits to Capital. London and New York: Verso.

Mazzucato, Mariana. 2018. The Value of Everything: Making and Taking in the Global Economy. New York City: PublicAffairs.